26

Years of experience

Trusted by 9,500+ global brands and organizations

WorkTime does not process, store, or transmit any Non-Public Personal Information (NPI) as defined under the Gramm-Leach-Bliley Act (GLBA). As a result, WorkTime is not subject to GLBA regulations. WorkTime software is designed exclusively for employee productivity monitoring and does not access, collect, or interfere with customer financial data or banking records. WorkTime is GLBA-exempt because: ✔ It does not collect or store NPI in any form. ✔ It does not access financial transaction systems or customer-related data. ✔ It does not require a GLBA-specific service provider agreement, as it does not handle protected financial information. ✔ It focuses solely on employee productivity metrics, without monitoring sensitive financial information.

GLBA PDFEven though WorkTime is GLBA-exempt, it offers a GLBA-safe mode (included in the Enterprise plan) to eliminate any risk of indirectly collecting Non-Public Personal Information (NPI), such as from: Website URLs, Window titles in apps or browsers. When GLBA-safe mode is enabled: sensitive data exposure risks are minimized; optional data, like window titles and full URLs, are disabled.

WorkTime is designed for a wide range of financial service providers, including banks, credit unions, insurance companies, mortgage lenders, brokerage firms, and investment companies. It helps these organizations stay GLBA-compliant while improving team performance and protecting sensitive customer data.

Financial

200

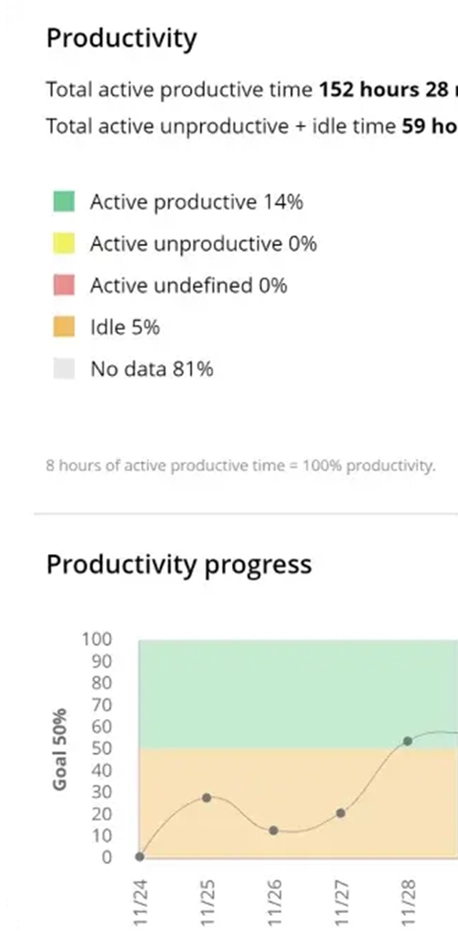

Since implementing WorkTime, employee performance has risen steadily each month. Employees can now self-manage and take greater responsibility for their own productivity.

Read moreInstant, steady!

WorkTime Green employee monitoring is the only non-invasive monitoring on the market. What is recorded?

WorkTime trial is all inclusive:

all features, unlimited employees.

No credit card required.

$6.99

/ employee / month billed monthly

$8.99

/ employee / month billed monthly

$10.99

/ employee / month billed monthly

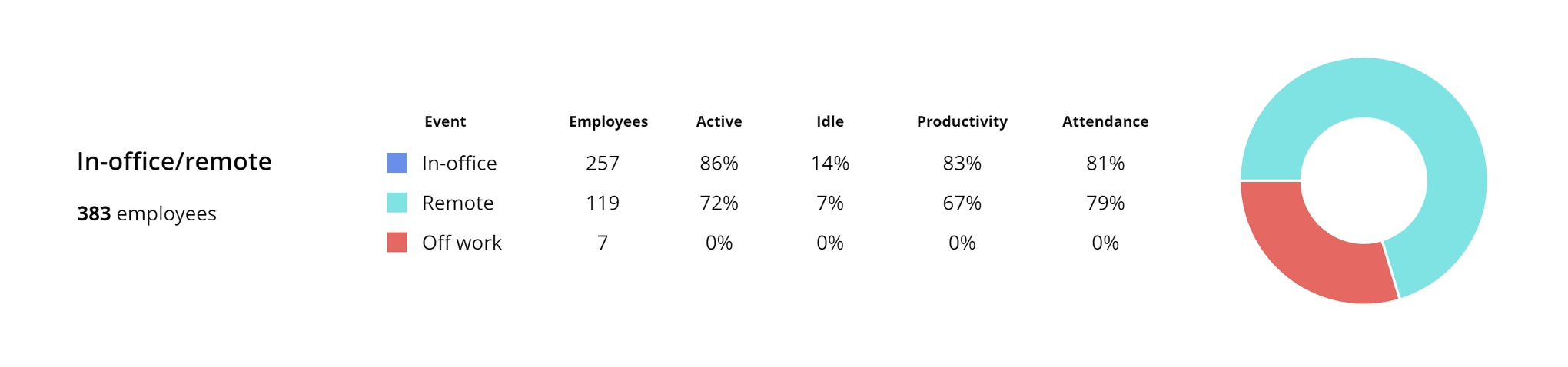

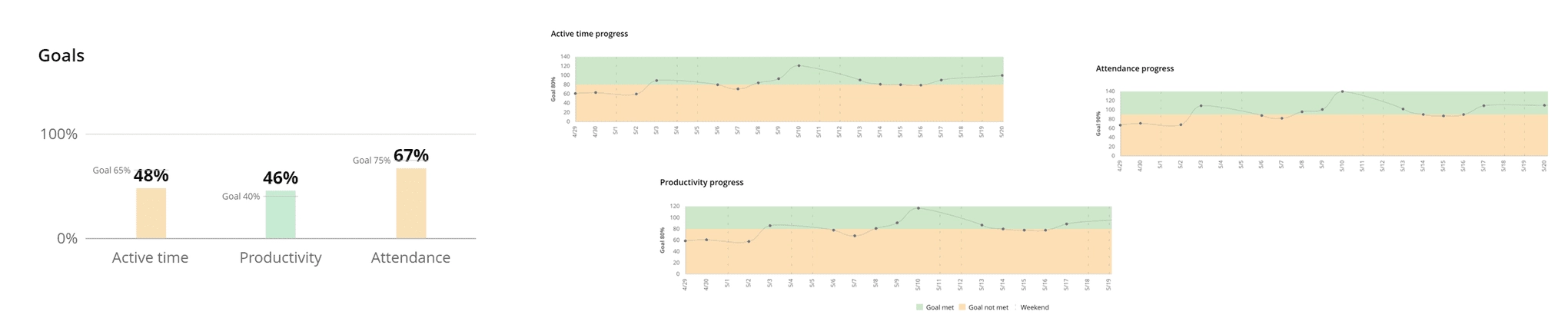

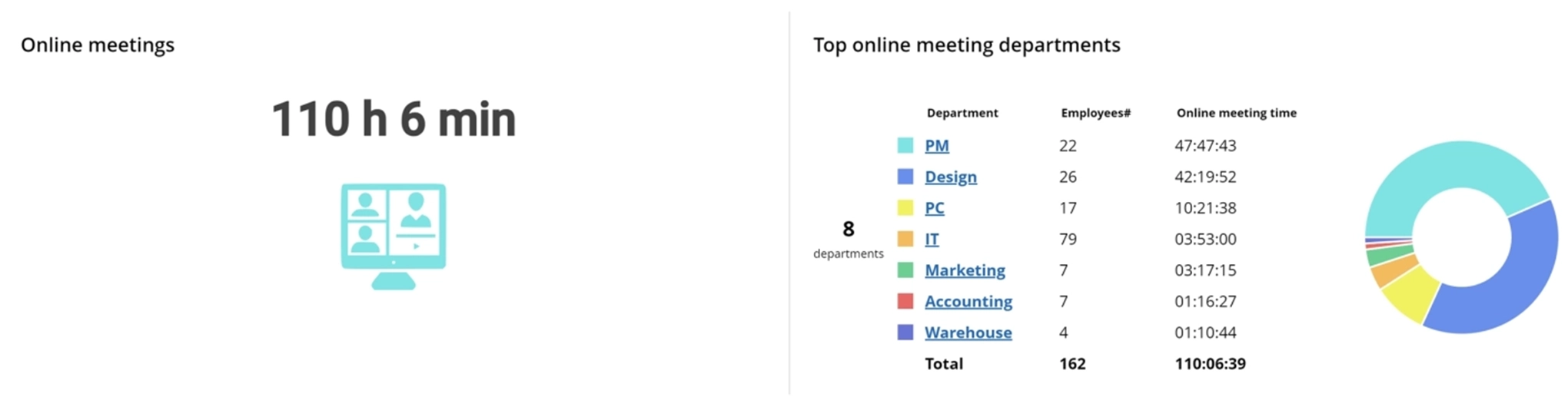

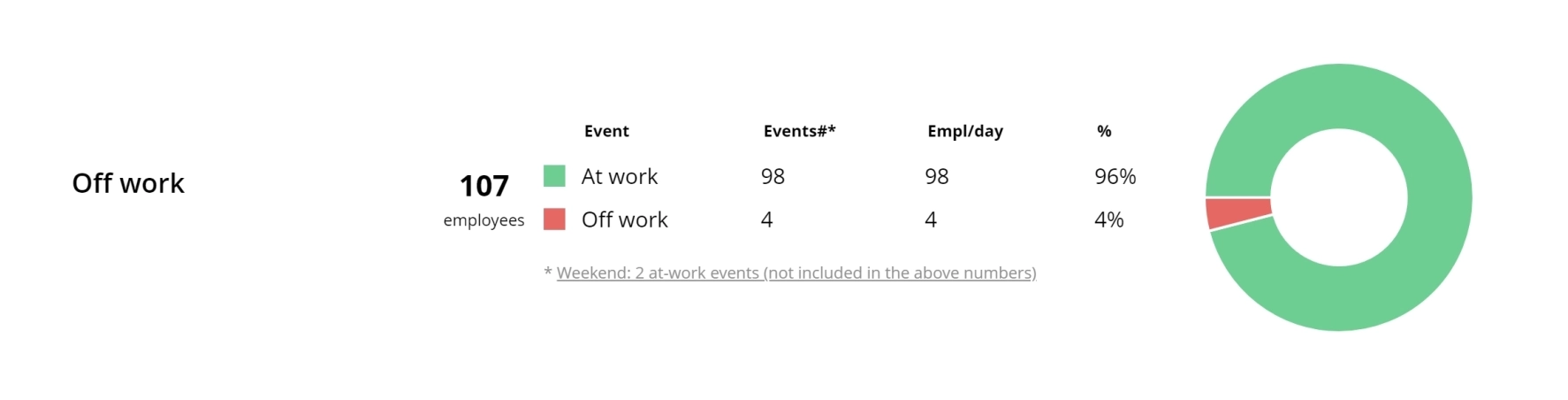

Attendance, active time, productivity, in-office/remote, progress and more!